Early withdrawal penalty calculator

The early withdrawal penalty doesnt apply to everyone in this situation. Some early withdrawals are tax free and penalty free.

How To Calculate The Penalty On An Early Withdrawal Of A Cd Fox Business

Use this early withdrawal penalty calculator to find the effective APY when closing a CD before maturity.

. If the pandemic has had negative effects on your finances temporary changes to the rules under the CARES Act may give you more flexibility to make an emergency withdrawal from tax-deferred retirement accounts during 2020. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Early Withdrawal Penalty 1-Year CD Early Withdrawal Penalty 5-Year CD.

The penalty is in terms of simple interest. The CARES Coronavirus Aid Relief and Economic Security Act in March 2020 allows for early withdrawals form 401k and individual retirement accounts IRA penalty-free. This means that the penalty doesnt factor in compounding and that aligns with many.

Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account. By using IRC Section 72t it is possible to eliminate the 10 early withdrawal penalty normally due for distributions from an IRA prior to age 59 12. It will calculate your effective net rate after the penalty.

Use our FREE Early Withdrawal Penalty Calculator to find the cost of closing a CD early. If you left your employer in. You may be asking yourself if its better to withdraw the money from the CD break the CD and deposit that into a new CD.

You should receive a Form 1099-INT from your bank or financial institution after the close of the tax year if youve been subject to an early withdrawal penalty. It can also be subject to an early-withdrawal penalty. Certain situations might qualify you for an exception to the IRA penalty tax on withdrawals taken before you reach age 59 12.

If you tap into it beforehand you may face a 10 penalty tax on the withdrawal in addition to income tax that youd owe on any type of withdrawal from a traditional 401k. The amount that can be withdrawn penalty-free is up to 100000. If you miss the 60-day cutoff for rolling over funds and youre at least 59 12 years old you wont have to pay the.

Among other things the CARES Act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½. However if you find yourself in a really tough spot borrowing from your 401k might be a better option than simply cashing out your balance. There are some early-withdrawal exceptions.

The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. You will also need to pay an income tax rate on the amount you withdraw since pre-tax dollars were used to fund the. If you return the cash to your IRA within 3 years you will not owe the tax payment.

Simply enter the term apy and penalty for early withdrawal and you will see a breakdown of what the effective APY would. 401K and other retirement plans. The ability to avoid the early withdrawal penalty if you separate in the year you turn 50 or 55 only applies if you leave your money in the TSP rollovers are subject to the penalty.

As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. If you withdraw funds early from a 401k you will be charged a 10 penalty. Typically it will be considered taxable income and subject to the 10 early withdrawal penalty.

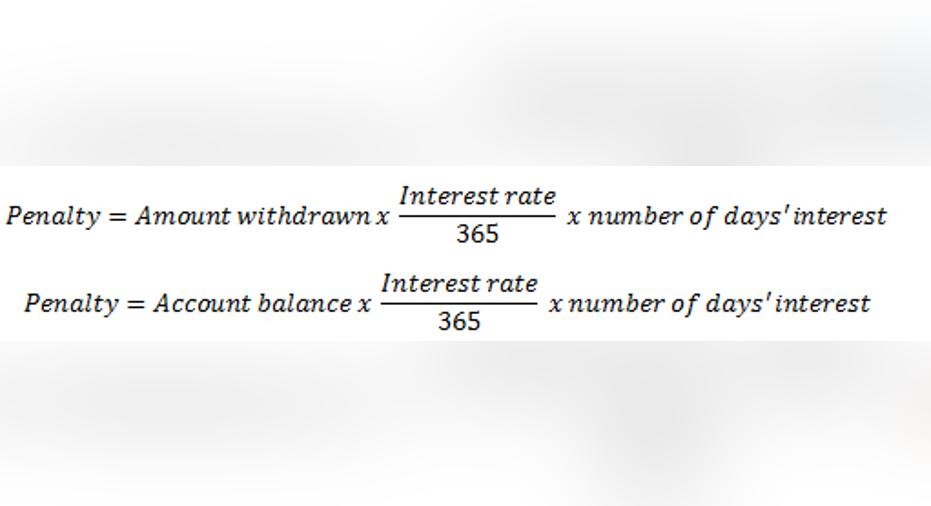

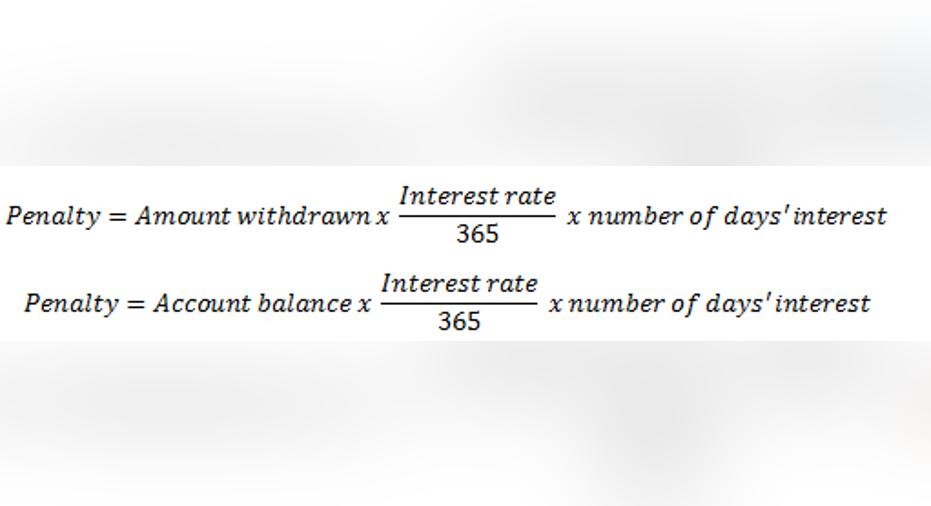

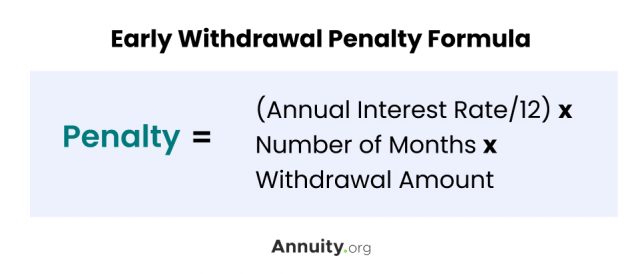

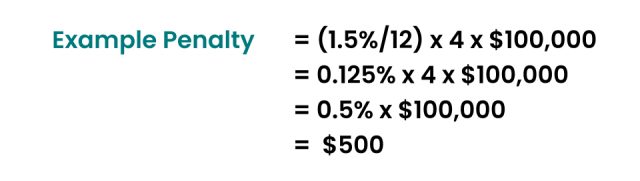

You may have to take money out of your traditional IRA earlier than youd planned. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. Traditional IRA Withdrawal Penalties To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10.

These hardship withdrawals can be taken if the account holder is affected by the COVID-19 pandemic. When to Break a CD Calculator. Once you reach age 595 you may withdraw money from your 401k penalty-free.

You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. Finding the Best CD Rates Since 1991. This type of withdrawal will be taxed.

The effective APY takes into account the loss from the early withdrawal penalty. Series of equal payments. Qualified retirement plan distributions doesnt apply to IRAs you receive after separation from service when the separation from service occurs in or after the year you reach age 55 age 50 for qualified public safety employees.

Or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your 401k. Early Withdrawal Penalty Calculator.

Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. Calculating the early-withdrawal penalty Because financial institutions compute interest and assess penalties in different ways its tough to use a set formula to determine an early-withdrawal. If you took an early withdrawal of 10000 from your 401k account the IRS could assess a 10 penalty on the withdrawal if its not covered by any of the exceptions outlined below.

The CD early withdrawal penalty calculator assumes three things. But in some cases your plan may allow you to take a penalty-free early withdrawal. Including the amount of the cash withdrawal from your retirement plan.

Ideally you want to leave your 401k alone until retirement. The Early Withdrawal Calculator the tool. The penalty will be reported in box 2 on the tax year 2021 form clearly identified as an early withdrawal penalty Its also reported in box 3 of Form 1099-OID original issue.

Is it Worth Paying an Early Withdrawal Penalty to Break my CD. Separation from service after age 55. When interest rates rise you may find that an old certificate of deposit CD is no longer earning a competitive interest rate.

The following COVID information was for 2020 Returns. If you withdraw money from your retirement account before age 59 12 you will need to pay a 10 early withdrawal penalty in addition to income. Reason with description provided from instructions for Form 5329.

By studying the information on this website like our 72t FAQ you will be able to learn the rules that govern Substantially Equal Periodic Payment SEPP Plans as defined by IRC Section 72t. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation. Once you turn age 59 12 you can withdraw any amount from your IRA.

3 Retirement Times Retirement Calculator Retirement Money Retirement Savings Calculator

How To Access Retirement Funds Early Nextadvisor With Time

The Best Iphone Keyboard Tips And Tricks Digital Trends Iphone Keyboard Digital Trends Iphone

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Pin On Financial Independence App

How To Make An Early Withdrawal From Your Ira Without Paying The Fee Individual Retirement Account Men Casual Retirement Accounts

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Cd Early Withdrawal Penalty By Bank Nerdwallet

Cd Early Withdrawal Penalty What To Know Credit Karma

How Are Cd Early Withdrawal Penalties Determined

12 Ways To Avoid The Ira Early Withdrawal Penalty

Pin On Money

Pin On Buying Selling A Home

Cd Early Withdrawal Penalty What To Know Credit Karma

How Are Cd Early Withdrawal Penalties Determined

How To Withdraw Early From A 401 K Nextadvisor With Time

401 K Early Withdrawal Guide Forbes Advisor